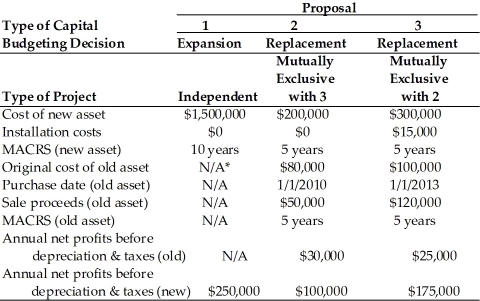

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

________________________________________________________  *Not applicable

*Not applicable

-For Proposal 3, the tax effect on the sale of the existing asset results in ________. (See Table 11.2)

Definitions:

Managed

A term that refers to something being handled, directed, governed, or controlled by a person or a group, often used in the context of businesses or services.

Motivated Salesperson

A sales professional who demonstrates high levels of enthusiasm, commitment, and drive to achieve sales targets and provide excellent customer service.

Independent Agents

Individuals or entities that represent multiple companies and sell products or services on behalf of these companies without being directly employed by them.

Manufacturers' Representatives

Individuals or businesses that sell manufacturers' products to wholesalers and retailers without taking ownership of the goods, operating on a commission basis.

Q7: Poor capital structure decisions can result in

Q11: Integrated Tagging<br>A)A programming language that converts unstructured

Q25: A sophisticated capital budgeting technique that can

Q40: A corporation is selling an existing asset

Q60: Leverage results from the use of equity

Q78: The treasurer typically manages a firm's cash,

Q102: For Proposal 3, the incremental depreciation expense

Q116: The internal rate of return for the

Q156: The breakeven point in dollars can be

Q167: The NPV of a project with an