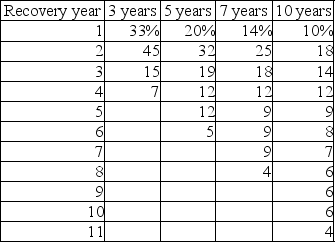

-A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash flow. The proposed machine will be disposed of at the end of its usable life of five years at an estimated sale price of $2,000. The machine has an original purchase price of $80,000, installation cost of $20,000, and will be depreciated under the five-year MACRS. Net working capital is expected to decline by $5,000. The firm has a 40 percent tax rate on ordinary income and long-term capital gain. The terminal cash flow is ________.

Definitions:

Mary Ainsworth

An American-Canadian developmental psychologist known for her work on attachment theory.

Attachment Styles

Patterns of behavior in relationships that affect how individuals bond with others, often rooted in early childhood experiences.

Secure

A term often used in psychology to describe a type of attachment style where individuals feel confident and self-assured in their relationships, often resulting from healthy developmental processes.

Contact Comfort

The physical and emotional comfort that an infant derives from being in close physical contact with its caregiver.

Q36: The three major cash flow components include

Q40: Whenever the percentage change in EBIT resulting

Q51: In selecting the best group of unequal-lived

Q53: By combining two projects with negatively correlated

Q62: With regard to dividend payments, which of

Q78: For Proposal 3, the book value of

Q121: The payback period of a project that

Q134: Corporate ethics policies typically apply to _

Q144: The degree of operating leverage will increase

Q179: For sales levels below the operating breakeven