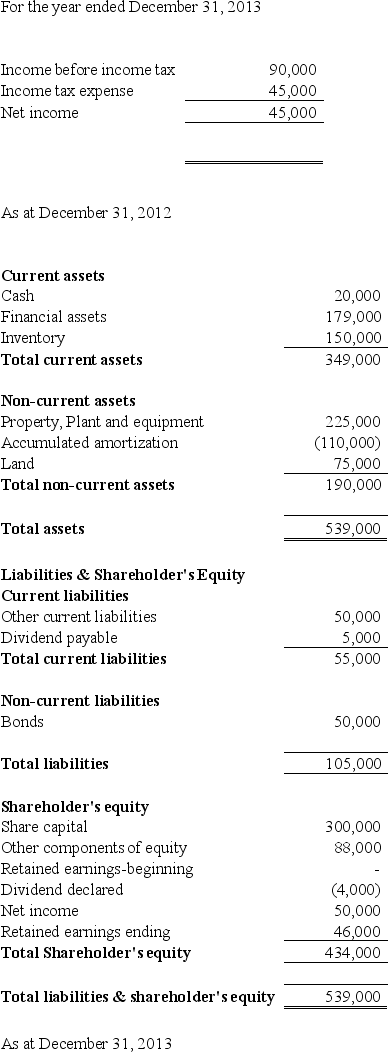

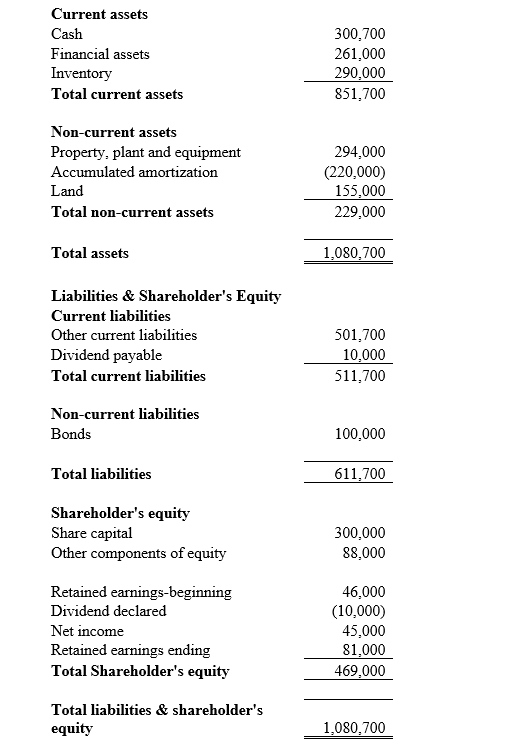

Mori Inc. is a company located in Canada and it uses the Canadian dollar as its functional currency. Mori Inc. began operations on January 1, 2012. Its shareholders are European. They would like the financial statements to be presented in Euros. The following is an excerpt from Mori Inc.'s financial statements for the 2012 and 2013 years. The changes in Other Comprehensive Income occurred evenly throughout the years. Dividends were declared at year-end.

The following exchange rates exist for the Euro relative to the Canadian dollar:

January 1, 2012 $1 Canadian = $1.40 Euro

December 31, 2012 $1 Canadian = $1.45 Euro

Average 2012 = $1 Canadian = $1.47 Euro

December 31, 2013 = $1 Canadian = $1.50 Euro

Average 2013 = $1 Canadian = $1.52 Euro

Required:

Translate the Mori Inc. financial statements as at December 31, 2013 from its functional currency to its presentation currency.

Definitions:

Relevant Cost

A cost that differs between alternatives in a decision. This term is synonymous with avoidable cost and differential cost.

Direct Materials

The raw materials that are directly traceable to the manufacturing of a product.

Direct Labour

The workforce directly involved in producing goods or delivering services, whose costs are directly attributable to the products or services.

Manufacturing Overhead

All manufacturing costs except direct materials and direct labor.

Q4: Evaluate/simplify the expression. - | -16 |<br>A)

Q22: In the determination of the functional currency,

Q26: The goodwill impairment test does not involve

Q29: On January 1, 2011 Glass Inc.

Q31: Recording the value of donated goods and

Q44: Arbiter Ltd. holds a 60% interest in

Q50: Yo Ltd. purchased a commercial food preparation

Q57: Service organizations are external organizations that perform

Q65: What are the objectives of internal control?

Q72: Physical security frameworks are useful to provide