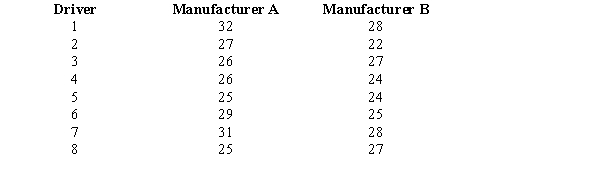

Exhibit 10-9 Two Major Automobile Manufacturers Have Produced Compact Cars with the with the Same

Exhibit 10-9

Two major automobile manufacturers have produced compact cars with the same size engines. We are interested in determining whether or not there is a significant difference in the MPG (miles per gallon) of the two brands of automobiles. A random sample of eight cars from each manufacturer is selected, and eight drivers are selected to drive each automobile for a specified distance. The following data show the results of the test.

-Refer to Exhibit 10-9. The test statistic is

Definitions:

Net Income

The total earnings of an individual or corporation, after all taxes and deductions have been subtracted from total revenue.

Schedule E

A tax document utilized to declare earnings and deficits from real estate rentals, royalty payments, partnerships, S corporations, estates, and trusts.

Schedule D

A form used with IRS tax returns to report capital gains and losses from transactions of capital assets.

Schedule K-1

A tax document issued for an investment in partnership entities, used to report the income, losses, and dividends of partners.

Q14: A goodness of fit test is always

Q34: A term that means the same as

Q36: A random sample of 53 observations

Q45: Information regarding the ACT scores of samples

Q71: Refer to Exhibit 13-4.The test statistic is<br>A)0.2<br>B)5.0<br>C)3.75<br>D)15

Q93: Refer to Exhibit 10-13.The null hypothesis

Q99: In interval estimation,the t distribution is applicable

Q120: Refer to Exhibit 10-4.The standard error of

Q127: If the coefficient of correlation is a

Q150: "DRUGS R US" is a large manufacturer