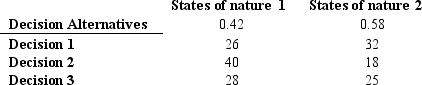

Assume you are faced with the following decision alternatives and two states of nature.The payoff table is shown below.

The probability of state of nature 1 is P(s1)= 0.42.

a.Determine the expected value of each alternative.

b.Which decision is the optimal decision?

c.Determine the expected value with perfect information.

d.Compute the expected value of perfect information.

Definitions:

Current Liabilities

Short-term financial obligations due within one year or within the normal operating cycle of the business, whichever is longer.

Current Ratio

The current ratio is a financial metric that measures a company's ability to pay short-term obligations with its short-term assets.

Short-term Debts

Obligations or loans that are due to be paid within one year or less, typically used to fund immediate operational needs.

Cash Basis Accounting

A financial recording approach where earnings and outlays are only acknowledged upon the receipt or payment of cash.

Q9: The upper and lower control limits of

Q16: When we say that the number is

Q16: Chocolate,Inc.manufactures 4 ounce chocolate bars.Random samples of

Q40: Refer to Exhibit 16-2.The test statistic F

Q50: A sampling unit<br>A)must have one element<br>B)may include

Q51: An automobile manufacturer must make an immediate

Q54: Translate the following into a standard-form categorical

Q54: A test used to determine whether or

Q63: In the linear trend equation,T = b<sub>0</sub>

Q133: State whether the following item expresses moral