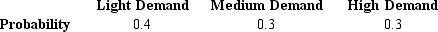

Michael,Nancy,& Associates (MNA)produce color printers.The demand for their printers could be light,medium,or high with the following probabilities.

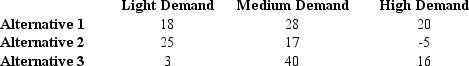

The company has three production alternatives for the coming period.The payoffs (in millions of dollars)associated with the three alternatives are shown below.

a.Compute the expected value of the three alternatives.Which alternative would you select,based on the expected values?

b.Compute the expected value with perfect information (i.e. ,expected value under certainty).

c.Compute the expected value of perfect information (EVPI).

Definitions:

Accumulated Depreciation

The cumulative sum of depreciation costs charged to a fixed asset from the time it was first utilized.

Accumulated Depreciation

The aggregate cost of a tangible asset that has been recognized as depreciation since the asset's initial use.

Trading In

The action of exchanging an old product for a discount on a new purchase.

Repairs

Expenditures to restore equipment, machinery, or property to its previous condition or to keep it in operational status without enhancing its value or extending its life.

Q11: If the lower-control limit of a P

Q20: The price relative is a price index

Q25: Refer to Exhibit 14-10.The coefficient of determination

Q29: A regression model relating units sold (Y),price

Q32: John has collected the following information on

Q37: Refer to Exhibit 17-4.The unweighted aggregate price

Q44: For the following argument,assign truth values

Q56: The quarterly sales of a company (in

Q63: Refer to Exhibit 21-1.The expected monetary value

Q78: Evaluate the following argument in accordance with