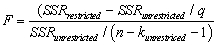

Give an intuitive explanation for  Name conditions under which the F-statistic is large and hence rejects the null hypothesis.

Name conditions under which the F-statistic is large and hence rejects the null hypothesis.

Definitions:

Risk-Free Asset

An investment that is expected to return its principal and interest with near certainty, such as government bonds from stable countries.

Risky Asset

An investment that has a significant degree of uncertainty in its returns.

Asset Allocation

The process of spreading investments among various categories of assets (e.g., stocks, bonds, real estate) to optimize risk and return.

Risk Tolerance

The degree of variability in investment returns that an investor is willing to withstand.

Q2: A VAR with five variables, 4 lags

Q6: A study, published in 1993, used

Q8: The time interval between observations can be

Q9: Analyzing the behavior of unemployment rates across

Q13: When testing the null hypothesis that

Q24: In the case of heterogeneous causal effects,

Q29: To decide whether or not the slope

Q39: The Report of the Presidential Commission

Q42: In econometrics, we typically do not rely

Q44: Your textbook uses the following example