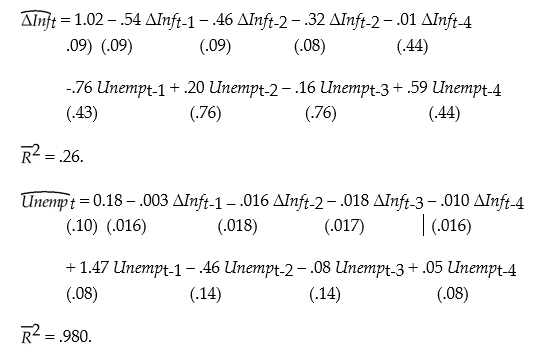

You have collected quarterly data on inflation and unemployment rates for Canada from 1961:III to 1995:IV to estimate a VAR(4)model of the change in the rate of inflation and the unemployment rate. The results are

(a)Explain how you would use the above regressions to conduct one period ahead forecasts.

(b)Should you test for cointegration between the change in the inflation rate and the unemployment rate and, in the case of finding cointegration here, respecify the above model as a VECM?

(c)The Granger causality test yields the following F-statistics: 3.75 for the test that the coefficients on lagged unemployment rate in the change of inflation equation are all zero; and 0.36 for the test that the coefficients on lagged changes in the inflation rate are all zero. Based on these results, does unemployment Granger-cause inflation? Does inflation Granger-cause unemployment?

Definitions:

Process Cost System

This accounting method is used for homogenous products and services to assign production costs evenly across all units produced, facilitating per unit cost analysis.

Job Order Cost System

An accounting system used to assign costs to individual jobs or batches, tracking the expenses associated with specific customer orders or projects.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to related products and services based on the activities they use.

Not A Product Cost

Indicates an expense not directly tied to the creation of products, such as administrative or sales expenses.

Q9: In order to make reliable forecasts with

Q13: The following data give the dates of

Q14: The two conditions for a valid instrument

Q33: For the OLS estimator <span

Q40: Describe the major differences between a randomized

Q53: Explain why the OLS estimator for the

Q56: There has been much debate about

Q96: The money supply is 1,500,of which 500

Q120: The largest component of planned aggregate expenditure

Q180: As disposable income increases,consumption<br>A) increases.<br>B) decreases.<br>C) remains