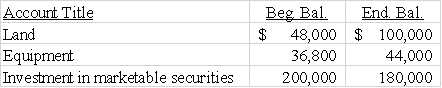

The Manhattan Corporation provided the following partial list of accounts,balances and activities for 2016:

Manhattan's income statement reported an $8,000 gain on sale of land that occurred when land that had cost $16,000 was sold for $24,000.The company also recorded a $10,000 loss on the sale of marketable securities.No additional marketable securities were purchased during the year.The company also sold equipment originally costing $6,000 with accumulated depreciation of $4,000 for $3,600.Purchases of additional land and equipment were cash transactions.

Required: Prepare the investing activities section of the statement of cash flows.

Definitions:

CS (Conditioned Stimulus)

A previously neutral stimulus that, after being paired with an unconditioned stimulus, elicits a conditioned response.

UCS (Unconditioned Stimulus)

In classical conditioning, an unconditioned stimulus is something that naturally and automatically triggers a response without any learning needed.

Stimulus Generalization

The process by which a response is elicited by stimuli that are similar but not identical to the conditioned stimulus in a conditioning experiment.

Classical Conditioning

A method of conditioning wherein two stimuli are steadily paired; a reaction, initially caused by the second stimulus, is at last caused by the first stimulus by itself.

Q2: At the end of the current accounting

Q52: How does the going concern assumption affect

Q64: A classified balance sheet is one that

Q67: After accruing all interest expense due as

Q70: Indicate whether each of the following statements

Q78: Show the effect of a stock dividend

Q84: The declaration and issuance of a stock

Q91: Kenyon Company experienced a transaction that had

Q135: Explain the difference between "transportation in" and

Q144: Discuss the advantages of establishing a line