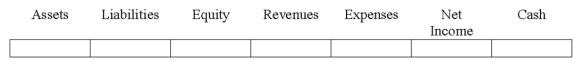

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.Use only one letter for each element.You do not need to enter amounts.

-Taylor Bennett began his sole proprietorship on February 28,2016 by contributing $25,000 of his own money to the business.Indicate the effects of this transaction on the financial statements.

Definitions:

Incentives

Incentives are rewards or penalties that motivate individuals or entities to act in a certain way, often used to influence economic behavior and decision-making.

Ability-to-pay Principle

A tax design principle that suggests taxes should be levied according to an individual's or entity's ability to bear them.

Regressive Tax

A tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases.

Regressive Income Tax

A tax system where the tax rate decreases as the taxable amount increases, placing a higher relative burden on low-income earners.

Q3: At the end of 2020,assuming the equipment

Q16: To maximize her combined test scores,Sharon should

Q24: Indicate whether each of the following statements

Q27: The additional cost of consuming three rather

Q32: Which of the following answers indicates the

Q34: On December 15,2016,the Binghampton Corporation established a

Q46: On December 31,2016,Briand Co.paid cash for interest

Q79: On September 10,2016,Howard Corporation received a check

Q121: Economic analysis that is concerned with both

Q130: Denver Co.issued bonds with a face value