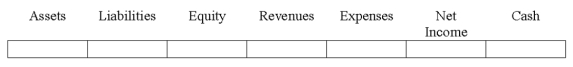

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.Use only one letter for each element.You do not need to enter amounts.

-Wheaton Company reissued 100 shares of treasury stock.The treasury stock had been purchased by Wheaton at $18 per share.The shares were reissued at a price of $20 per share.

Definitions:

Times Interest Earned Ratio

A financial ratio measuring a company's ability to meet its interest obligations based on current earnings, indicating financial stability.

Net Profit Margin Percentage

A financial metric that shows the percentage of profit a company makes for every dollar of sales, calculated by dividing net profit by total revenue.

Average Sale Period

A financial metric measuring the average time it takes for a company's inventory to turn into sales, often seen as part of inventory turnover analysis.

Price-earnings Ratio

A valuation metric that compares a company's current share price to its per-share earnings.

Q6: The entry to record the dividend on

Q33: Which of the following cash flows would

Q69: The following information is for Cleveland Company:<br>Additional

Q80: Which of the following terms is used

Q87: Based on this information alone,the amount of

Q111: At the end of the accounting period,Houston

Q134: Davis Corporation borrowed $50,000 on January 1,2016.The

Q145: Which accounts would affect gross margin?<br>A)Account numbers

Q150: The following events pertain to the Boardwalk

Q185: The Latin expression for "all else equal"