Use the following to answer questions

In December 2016,Lucas Corporation sold merchandise for $10,000 cash.Lucas estimated that $700 of warranty claims might be filed in regard to these sales.On February 12,2017,warranty work amounting to $550 was performed for one of the customers ($430 labor paid in cash and $120 from the materials inventory).

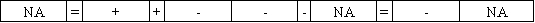

53.Which of the following answers correctly shows the effect of the recognition of the warranty obligation at the end of 2016 on the financial statements of Lucas?

A.

B.

C.

D.

Answer: D

Answer: D

Learning Objective: 09-04

Topic Area: Warranty obligations

AACSB: Analytical Thinking

AACSB: Knowledge Application

AICPA: FN Measurement

AICPA: BB Critical Thinking

Blooms: Analyze

Blooms: Apply

Level of Difficulty: 2 Medium

Feedback: The entry to estimate future warranty costs related to 2016 sales increases expenses (warranty expense),which decreases net income and equity,and increases liabilities (warranties payable).

-Which of the following reflects the effect of the year-end adjusting entry to record estimated warranty expense?

Definitions:

Halo Effect

A psychological phenomenon where an individual's overall impression of a person, brand, or product positively influences their feelings and thoughts about that entity's specific traits.

Strictness

The quality of exacting standards or stringent enforcement of rules, often applied in disciplinary contexts.

Performance Appraisals

The process of evaluating an employee's job performance and productivity in relation to established criteria and organizational objectives.

Labour Market

The labour market is the arena in which employers seek employees to hire and where individuals offer their skills and labor in exchange for wages.

Q4: Bristol Corporation reported a $6,200 balance in

Q43: Morrison Company issued $200,000 of 10-year,8% bonds

Q55: List three measures that a business can

Q59: Napoli Industries had net income for the

Q70: Establishment of a petty cash fund is

Q76: Lack of ease in transferability of ownership

Q96: The stock market crash in 1929 led

Q120: Which internal control procedure addresses the idea

Q133: Articles of incorporation,prepared by a business that

Q145: Which method of depreciation generally allocates the