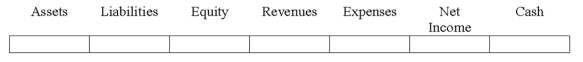

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

-Pearl Company sold merchandise to a customer for $800 cash in a state where the sales tax rate is 5%.(Ignore the effect of cost of goods sold. )

Definitions:

Stackelberg Leader

A firm that has a dominant position in a market or industry, dictating terms and strategies that other firms, or followers, adapt to.

Lump Sum Tax

A tax that is a fixed amount, no matter the change in circumstance of the taxed entity, not affected by the taxpayer's income or activity level.

Outputs

Refers to the goods or services produced by a company or economy, indicative of productivity or production levels.

Discount Sources

Various origins from which price reductions can be obtained, such as coupons, sales promotions, or bulk buying.

Q3: Marvel Company sold land that cost $440,000

Q21: Craig Company experienced an accounting event that

Q27: Prepare the financing activities section of Moreno's

Q31: Perez Company began 2016 with a balance

Q38: When is it acceptable to use the

Q85: Joseph Company issued a one-year,6% note to

Q95: Which of the following would not be

Q103: If a company sells equipment at a

Q110: The direct write-off method does a better

Q143: Amortization of a discount on bonds payable