Use the following to answer questions

In December 2016,Lucas Corporation sold merchandise for $10,000 cash.Lucas estimated that $700 of warranty claims might be filed in regard to these sales.On February 12,2017,warranty work amounting to $550 was performed for one of the customers ($430 labor paid in cash and $120 from the materials inventory).

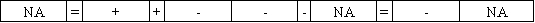

53.Which of the following answers correctly shows the effect of the recognition of the warranty obligation at the end of 2016 on the financial statements of Lucas?

A.

B.

C.

D.

Answer: D

Answer: D

Learning Objective: 09-04

Topic Area: Warranty obligations

AACSB: Analytical Thinking

AACSB: Knowledge Application

AICPA: FN Measurement

AICPA: BB Critical Thinking

Blooms: Analyze

Blooms: Apply

Level of Difficulty: 2 Medium

Feedback: The entry to estimate future warranty costs related to 2016 sales increases expenses (warranty expense),which decreases net income and equity,and increases liabilities (warranties payable).

-Which of the following reflects the effect of the year-end adjusting entry to record estimated warranty expense?

Definitions:

Cultural Value Statements

Declarations that communicate the core principles and ethical standards that guide the behavior, decisions, and actions of an organization or community.

Diversity

The inclusion of individuals representing more than one national origin, color, religion, socioeconomic stratum, sexual orientation, etc., in a group or organization.

Creativity

The ability to produce original and valuable ideas.

Marketing Strategies

Plans developed by organizations to promote and sell their products or services to targeted audiences.

Q27: If the original expected life remained the

Q28: Kincaid's entry to recognize the write-off of

Q45: Assuming that the unadjusted bank balance was

Q47: Park Enterprises issued bonds with a term

Q48: Treasury Stock is an equity account with

Q78: Choose the correct answer to complete the

Q81: What account is used to record the

Q121: Glebe Company accepted a credit card account

Q131: The cost of natural resources includes the

Q136: What account is debited to record an