Use the following to answer questions

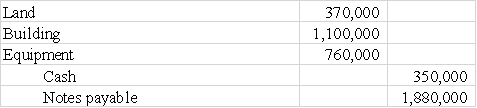

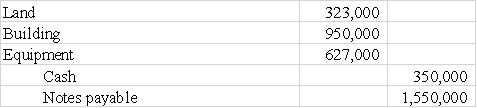

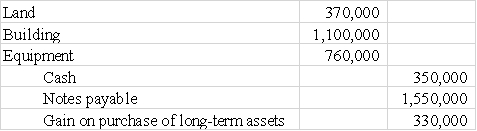

Harding Corporation acquired real estate that contained land,building and equipment.The property cost Harding $1,900,000.Harding paid $350,000 and issued a note payable for the remainder of the cost.An appraisal of the property reported the following values: Land,$374,000;Building,$1,100,000 and Equipment,$726,000.

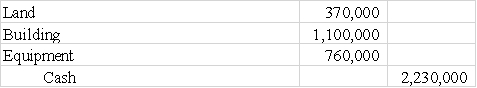

-What journal entry would be used to record the purchase of the above assets?

Definitions:

Cardiac Output

The volume of blood pumped by the heart per minute, a critical measure of heart function and efficiency.

Peripheral Tissue Perfusion

The process of delivering blood to the outer surfaces of the body, vital for delivering oxygen and nutrients to various tissues.

Cardiac Contractility

The ability of heart muscle cells to contract, determining the force with which the heart pumps blood throughout the body.

Angiotensin-Converting Enzyme

A key enzyme in the renin-angiotensin system, involved in regulating blood pressure by converting angiotensin I to the potent vasoconstrictor angiotensin II.

Q14: Montana Company was authorized to issue 200,000

Q21: San Jose Company issued five-year 8% bonds

Q22: A corporation must record a liability for

Q37: The face value of Accounts Receivable plus

Q37: On August 1,2016,Denver & Co.borrowed money from

Q89: Indicate whether each of the following items

Q101: The Mason-Dixon partnership was formed on January

Q133: Articles of incorporation,prepared by a business that

Q136: The following information is available from Avalon,Inc.for

Q144: Green Corporation has the following stock outstanding:<br>In