Use the following to answer questions

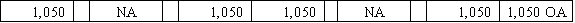

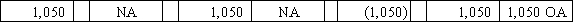

On December 31,2015,the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible.Loudoun uses the allowance method of accounting for uncollectible accounts.In February 2016,one of Loudoun's customers failed to pay his $1,050 account and the account was written off.On April 4,2016,this customer paid Loudoun the $1,050.

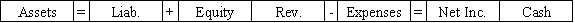

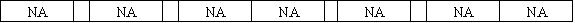

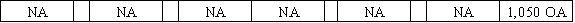

-Which of the following answers correctly states the effect of recording the collection of the reestablished receivable on April 4,2016?

Definitions:

Cylinder Seal

A cylindrical piece of stone usually about an inch or so in height, decorated with an incised design, so that a raised pattern is left when the seal is rolled over soft clay. In the ancient Near East, documents, storage jars, and other important possessions were signed, sealed, and identified in this way. Stamp seals are an earlier, flat form of seal used for similar purposes.

Sound Box

The part of a musical instrument where the sound resonates, often found in stringed instruments like guitars or violins.

Colonnade

A series or row of columns, usually spanned by lintels.

Persepolis

An ancient city in Persia, renowned for its monumental architecture and cultural significance, serving as a ceremonial capital of the Achaemenid Empire.

Q5: West Company borrowed $10,000 on September 1,2016

Q32: Singh Company sold 75 units @ $350

Q44: Straight-line interest amortization of a premium or

Q49: Which one of the following would not

Q60: The Boothe Company paid $9,000 to extend

Q88: Indicate whether each of the following statements

Q96: A savings account or certificate of deposit

Q106: Indicate whether each of the following statements

Q117: Credit entries<br>A)decrease liability accounts.<br>B)increase asset accounts.<br>C)increase the

Q131: If some inventory items have declined in