Use the following to answer questions

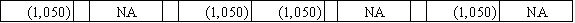

On December 31,2015,the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible.Loudoun uses the allowance method of accounting for uncollectible accounts.In February 2016,one of Loudoun's customers failed to pay his $1,050 account and the account was written off.On April 4,2016,this customer paid Loudoun the $1,050.

-Which of the following answers correctly states the effect of Loudoun Company's February 2016 entry to write off the customer's account?

Definitions:

Annual Sales

The total revenue generated from the sale of goods or services over the course of a year.

CCA Class

A categorization within the Canadian taxation system specifying the depreciation rate applicable to different types of property or equipment for tax purposes.

Net Present Value

A calculation that determines the present value of an investment's expected cash flows, minus the initial investment cost, taking into account the time value of money.

Marginal Tax Rate

The rate at which the last dollar of a taxpayer’s income is taxed, indicating the percentage of tax applied to their income for each tax bracket in which they qualify.

Q10: At the end of the 2016 accounting

Q19: Title search and document costs incurred to

Q61: Petty cash funds are maintained on an

Q101: How do accounting controls differ from administrative

Q115: Generally accepted accounting principles require that,when the

Q126: Hough Company recorded a business event in

Q129: How is the number of days to

Q135: Indicate whether each of the following statements

Q135: In preparing the bank reconciliation for Heath

Q156: Scott Company purchased a new machine on