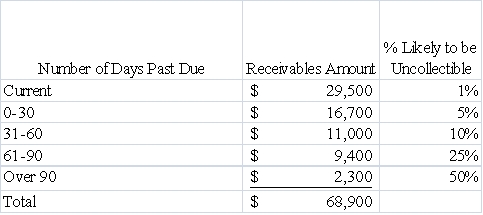

Barton Corporation uses the percent of receivables method of accounting for uncollectible accounts.As of December 31,2016,prior to estimating uncollectible accounts expense,Barton's balance of accounts receivable was $68,900,the balance of allowance for doubtful accounts was $2,500,and total sales for 2016 were $875,000.On December 31,Barton aged its receivables and determined the following:

Indicate whether each of the following statements is true or false.

_____ a)Barton will report Net Realizable Value of Accounts Receivable equal to $63,170 on its December 31,2016 balance sheet.

_____ b)Barton will report Uncollectible Accounts Expense of $5,730 on its 2016 income statement.

_____ c)The December 31 adjusting entry related to uncollectible accounts will increase liabilities and decrease equity by $3,230.

_____ d)The method Barton uses to account for uncollectible accounts is known as the balance sheet approach.

_____ e)Write-offs of uncollectible accounts in 2017 will reduce Barton's net realizable value of receivables.

Definitions:

Bootstrap

A resampling technique that involves repeatedly drawing samples from a dataset to estimate a population parameter.

Bias

A systematic error or deviation from true values or processes in data collection, analysis, interpretation, and review that can lead to incorrect conclusions.

Resample Means

A statistical method involving the calculation of the mean from multiple subsamples of a dataset to assess variability.

Original Data Set

The initial collection of data or observations before any processing or analysis has been conducted.

Q2: Which of the following statements regarding the

Q51: The following is a random list of

Q68: In preparing the bank reconciliation for Heath

Q77: In preparing the bank reconciliation for Heath

Q85: Tetra Company purchased 2,000 units of inventory

Q91: In a bank reconciliation,a customer's NSF check

Q92: For internal control purposes,what is meant by

Q101: How do accounting controls differ from administrative

Q111: Franklin Company issued a $40,000 note to

Q141: An increase to a liability account is