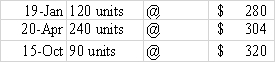

Max Company's first year in operation was 2016.The following inventory purchase information comes from Max's accounting records for the year.

In December 2016,Max sold 350 units for $480 each.Operating expenses for the year were $30,000,and the tax rate was 30%.

Required: a)Calculate the cost of goods sold by LIFO and by FIFO.

b)What amount of income tax would Max have to pay if it uses LIFO? If it uses FIFO?

c)Assuming that the results for 2016 are representative of what Max can generally expect,would you recommend that the company use LIFO or FIFO? Explain.

Definitions:

Cash Receipts Journal

A dedicated financial journal that tracks all cash inflows or money received by a business.

Sales Journal

An accounting ledger in which sales of services or goods on credit are recorded, also known as the sales book.

Closing Entries

Journal entries made at the end of an accounting period to transfer temporary account balances to permanent accounts.

Unearned Rent

Income received by a landlord for rent that has been paid in advance, which is considered a liability until the period it pertains to occurs.

Q33: Regarding the effects of end-of-period adjustments,state whether

Q45: How is the accounts receivable turnover computed?

Q47: The amount of uncollectible accounts expense recognized

Q80: When a company accepts a credit card

Q86: The types of resources needed by a

Q86: The temperature of 40.0 degrees Fahrenheit is

Q101: How do accounting controls differ from administrative

Q107: Classify each of the following events as

Q139: Which of the following financial statement elements

Q146: The return on assets ratio for Wichita