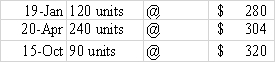

Max Company's first year in operation was 2016.The following inventory purchase information comes from Max's accounting records for the year.

In December 2016,Max sold 350 units for $480 each.Operating expenses for the year were $30,000,and the tax rate was 30%.

Required: a)Calculate the cost of goods sold by LIFO and by FIFO.

b)What amount of income tax would Max have to pay if it uses LIFO? If it uses FIFO?

c)Assuming that the results for 2016 are representative of what Max can generally expect,would you recommend that the company use LIFO or FIFO? Explain.

Definitions:

Outstanding

Exceptionally good or noticeable in comparison to others; distinguished beyond the norm.

E-Leadership

A form of leadership practiced in a context where work is mediated by information technology.

Micromanaged

A management style where a manager closely observes or controls the work of their subordinates.

Mediated

In the context of communication or disputes, refers to the involvement of a neutral third party to facilitate discussions and help reach an agreement.

Q1: Which of the following accounts would not

Q15: Which of the following cash transactions results

Q41: Making a loan to another party is

Q45: How is the accounts receivable turnover computed?

Q46: Benson Co.purchased land and paid the full

Q53: Fill in the blanks indicated by the

Q61: What is the effect on the accounting

Q75: Cornelius Company purchased supplies on account.What account

Q82: Use the following information to prepare an

Q139: Which of the following financial statement elements