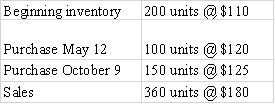

The following information is for Poole Company for 2016:

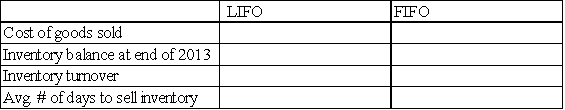

Required: a)Assuming that Poole uses the LIFO cost flow method,determine how much product cost would be allocated to Cost of Goods Sold,and how much to Merchandise Inventory at the end of the year.

b)Based on your results from part a,calculate inventory turnover and average number of days to sell inventory.

c)Assuming that Poole uses the FIFO cost flow method,determine how much product cost would be allocated to Cost of Goods sold,and how much to Merchandise Inventory at the end of the year.

d)Based on your results from part c,calculate inventory turnover and average number of days to sell inventory.

e)Compare your results from parts b and d.Do LIFO and FIFO give the same results for inventory turnover? Which is higher,and why?

Definitions:

James II

King of England, Scotland, and Ireland who reigned from 1685 to 1688, his policies of religious tolerance toward Catholics led to the Glorious Revolution, which resulted in his deposition and the establishment of constitutional monarchy in Britain.

Nathaniel Bacon

led Bacon's Rebellion in 1676, an armed rebellion against the colonial government of Virginia, reflecting settlers' frustrations with Native American policies and governance.

Spanish

Pertaining to Spain, its people, culture, or language, which is a Romance language and the second most natively spoken language in the world.

Pueblo Rituals

Traditional ceremonies and practices of the Pueblo Indigenous peoples, deeply rooted in their spiritual beliefs, cultural heritage, and connection to the environment.

Q25: How many significant figures should be included

Q45: Young Company reported the following balance

Q53: On September 1,2016,Diaz Company loaned $10,000 to

Q59: An adjusting entry recorded as a debit

Q63: Indicate whether each of the following statements

Q65: List three of the five interrelated components

Q86: The last-in,first-out cost flow method assigns the

Q91: The purpose of the accrual basis of

Q102: What is the effect on the accounting

Q108: Furst Co.uses the allowance method to account