Below are listed several transactions of Phelps Company during 2016.

1.Provided services to customers for cash,$70,000

2.Purchased land by paying cash,$32,000

3.Paid rent for 6 months,$24,000

4.Acquired cash of $50,000 by issuing common stock

5.Purchased office supplies on account,$5,400

6.Receive payment of $6,000 from a customer for services that will be provided over the next six months.

Required:

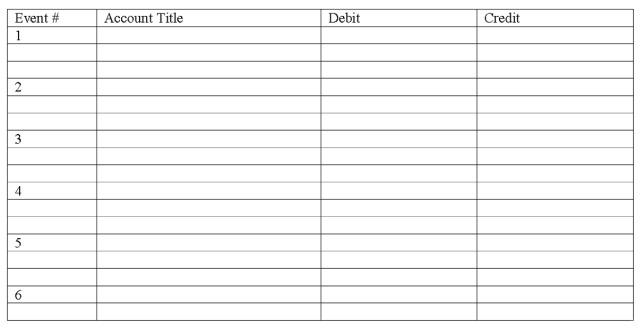

a)Prepare journal entries for each of the preceding transactions,using the general journal below.

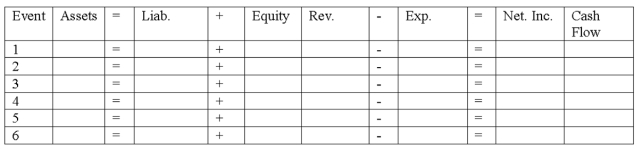

b)Show how each transaction affects the financial statements model by inserting amounts.Precede the amount with a minus sign if the transaction reduces that section of the equation.Precede a cash outflow amount with a minus sign.Enter 0 for items not affected.

In the Activity Type column,use the letters OA for operating activities,IA for investing activities,and FA for financing activities.Insert NA if cash flow is not affected.

Definitions:

Visual Search

The process of scanning the environment with the eyes to find a specific object or feature among other objects.

Array

A systematic arrangement of similar objects, typically in rows and columns, or a data structure in computer science that consists of a collection of elements identified by at least one index or key.

David Marr's Model

A theory in cognitive science that describes vision as proceeding from a 2D view of the world to a 3D one through a series of processing stages.

Bottom-Up Knowledge

Knowledge processing that starts with the senses and the actual perception of stimuli, moving towards higher-level cognitive functions.

Q23: Rainey Company's true cash balance at October

Q38: Bell Company has provided the following figures

Q40: The direct write-off method of accounting for

Q40: A company uses a cost flow method

Q121: The Sarbanes-Oxley Act includes several significant reforms

Q133: Are outstanding checks an adjustment to the

Q135: Double entry accounting requires that every entry

Q141: An increase to a liability account is

Q143: The entry to recognize depreciation expense incurred

Q154: On August 1,2016,Benjamin and Associates collected $18,000