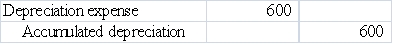

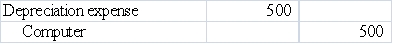

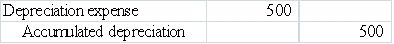

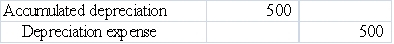

Vargas Company purchased a computer for $3,000 on January 1,2016.The computer is estimated to have a 5-year useful life and a $500 salvage value.What adjusting entry would Vargas record on December 31,2016 to recognize expense related to use of the computer?

Definitions:

Declarative

Pertaining to knowledge that can be consciously recalled and articulated, such as facts or information.

Procedural

refers to a method or process in the execution of actions or operation of systems, often opposed to declarative knowledge which is about facts or things known.

Self-efficacy

An individual’s belief in their capacity to execute behaviors necessary to produce specific performance attainments, shaping how they think, feel, and act.

Declarative

Pertaining to the ability to consciously recall facts and knowledge, part of explicit memory.

Q10: At the end of the 2016 accounting

Q12: Carson Company has an inventory turnover of

Q33: Chadwick Company's sales for 2016 were $8,700,000.Its

Q44: Blake Company established a petty cash fund

Q64: Which of the following statements about materiality

Q92: For which of the following would net

Q95: Indicate whether each of the following statements

Q104: In a period of rising prices,use of

Q110: When a company purchases a depreciable asset,it

Q138: Calculating the debt to assets ratio measures