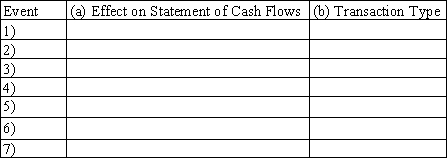

The following transactions apply to Kellogg Company.

1)Issued common stock for $20,000 cash

2)Provided services to customers for $38,000 on account

3)Purchased land for $15,000 cash

4)Incurred $29,000 of operating expenses on account

5)Collected $35,000 cash from customers for services provided in event #2

6)Paid $27,000 on accounts payable

7)Paid $2,000 dividends to stockholders

Required:

a)Identify the dollar amount effect on the Statement of Cash Flows,if any,for each of the above transactions.Precede a cash outflow amount with a minus sign.Enter NA for items not affected.

b)Indicate whether each transaction involves operating,investing,or financing activities.Enter NA for items not affected.

c)Classify the above accounting events into one of four types of transactions (asset source,asset use,asset exchange,claims exchange).

Definitions:

Nonprofit

Organizations that operate without the primary goal of earning profits for their owners or shareholders but rather to serve the public good or a specific societal need.

Success

The accomplishment of an aim or purpose, often marked by achieving specified goals or attaining prosperity.

Revenue

The income generated from normal business operations or other activities, calculated before any expenses are subtracted.

Governments

Governments are formal structures and institutions that hold the authority to establish rules, regulations, and policies for a geographic area and its population.

Q59: Which of the following is not an

Q59: Which of the following is not a

Q74: A business and the person who owns

Q81: On January 1,2015,Chavez Company had beginning balances

Q98: Revenue on account amounted to $9,000.Cash collections

Q125: Which of the following items is an

Q127: Classify each of the following transactions for

Q127: Chow Company earned $1,500 of cash revenue,paid

Q142: The Campbell Company began operations on January

Q147: Bijan Corporation recorded the adjusting entry to