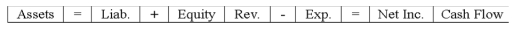

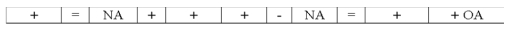

Which of the following could represent the effects of an asset source transaction on a company's financial statements?

Definitions:

Average Tax Rate

The percentage of total income that is paid in taxes.

Interest Income

Earnings from investments in interest-bearing accounts, bonds, or other financial instruments that pay periodic interest.

Eligible Dividends

Dividends designated by a company for tax purposes, which may qualify for preferential tax treatment under certain jurisdictions.

Repurchase

The act of a company buying back its own shares from the marketplace, which can affect the company's share price and capital structure.

Q12: In isotopic notation atomic number is represented

Q26: The amount of retained earnings appearing on

Q31: A loss resulting from application of the

Q40: The following is a list of all

Q57: Dry ice undergoing sublimation is an example

Q78: In a market,a company that manufactures cars

Q94: Generally accepted accounting principles restrict or limit

Q108: Are liability accounts increased by debits or

Q108: Glasgow's ending inventory under LIFO would be:<br>A)$2,730.<br>B)$2,460.<br>C)$2,220.<br>D)$1,950.

Q128: Which of the following circumstances is not