The transactions listed below apply to Bates Company for its first year in business.Assume that all transactions involve the receipt or payment of cash.

Transactions for the year 2015:

1)Issued common stock to investors for $25,000 cash.

2)Borrowed $18,000 from the local bank.

3)Provided services to customers for $28,000.

4)Paid expenses amounting to $21,400.

5)Purchased a plot of land costing $22,000.

6)Paid a dividend of $15,000 to its stockholders.

7)Repaid $12,000 of the loan listed in item 2.

Required:

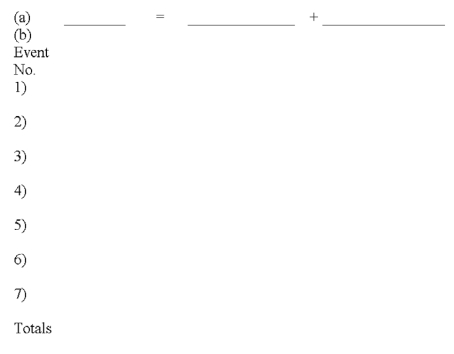

(a)Fill in the headings to the accounting equation shown below.

(b)Show the effects of the above transactions on the accounting equation.Precede the amount with a minus sign if the transaction reduces that section of the equation.

Definitions:

Breaking Even

The point at which total costs and total revenues are equal, resulting in no net loss or gain.

Taking a Loss

The action of selling an asset for less than its purchase price, resulting in a financial loss for the seller.

Regulated Natural Monopolies

Companies that operate in a market with no competition due to high infrastructure costs, but their prices and services are regulated by the government to protect consumers.

Public Utilities

Companies that provide essential services such as water, electricity, and telecommunications to the public, usually subject to government regulation.

Q33: The charge of a cation is<br>A)positive.<br>B)negative.<br>C)neutral.

Q45: According to the Law of Conservation of

Q52: The mass of a copper atom is

Q55: Zimmerman Company sold land for $25,000 cash.The

Q76: A sample of an unknown substance was

Q76: Sometimes the recognition of revenue is accompanied

Q77: The significant figures in a number include

Q92: There are three types of chemical substances:

Q115: During a period of rising prices,a company's

Q141: The following transactions apply to Kellogg Company.<br>1)Issued