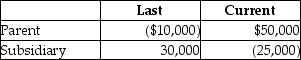

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year,the group files a consolidated tax return.The results for last year and the current year are:

Taxable Income

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Year 1

The first year in a given time series or financial model, often the base or starting year for analysis.

Average Operating Assets

The average value of the assets used in the normal operations of a business, typically calculated over a specific period of time.

Combined Margin

A financial metric that calculates the total profitability of a product by combining different types of margins, such as gross and net margins.

Investment Opportunity

A financial investment or venture that has the potential to yield returns or profits to the investor.

Q8: In extracellular fluid the most abundant anion

Q9: Identify which of the following statements is

Q25: Describe the products of the three primary

Q39: Which of the following definitions of Sec.338

Q47: Name the layer labeled D<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6090/.jpg" alt="Name

Q56: Which condition listed is a malpresentation in

Q71: On December 31 of last year,Alex and

Q73: Taxable acquisition transactions can either be a

Q83: Identify which of the following statements is

Q88: Parent Corporation purchases all of Target Corporation's