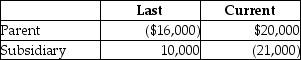

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year.the group files a consolidated return.

Taxable Income

How much of the Subsidiary loss can be carried back to last year?

Definitions:

Long-Run Usage

Analysis or operations that consider a longer time horizon, focusing on trends and strategies sustainable in the future.

Reciprocal Method

An accounting method used for allocating costs between interdependent departments, accurately reflecting the shared services costs.

Mutual Provision

Mutual provision relates to the sharing or exchange of services, resources, or benefits between parties, often within a cooperative or collaborative framework.

Support Department Cost Allocation

The process of distributing indirect costs from support departments, such as Human Resources or IT, to operational departments or product lines.

Q11: Which of the following is a noninvasive

Q25: Martin is a limited partner in a

Q27: Which of the following cells secretes intrinsic

Q40: Identify which of the following statements is

Q54: Where does glycolysis take place?<br>A)Cytosol<br>B)Plasma membrane<br>C)Nucleus<br>D)Mitochondria<br>E)Golgi Apparatus

Q61: Identify which of the following statements is

Q67: Gould Corporation distributes land (a capital asset)worth

Q73: To be an affiliated group,the parent corporation

Q84: Brent is a limited partner in BC

Q113: Identify which of the following statements is