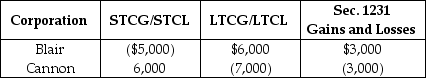

Blair and Cannon Corporations are the two members of an affiliated group.No prior net Sec.1231 losses have been reported by any group member.The two corporations report consolidated ordinary income of $100,000 and gains and losses from property transactions as follows:

Included in the above totals is $6,000 of long-term capital losses recognized by Cannon on an intercompany transaction.Excluded from the above is a $4,000 Sec.1231 gain originally deferred by Cannon that must be reported by the group in the current year.

Which one of the following statements is incorrect?

Definitions:

Coping Skills

Techniques or strategies used to manage stress, adapt to challenging situations, and maintain emotional well-being.

Hospitalized Patients

Individuals admitted to a hospital for treatment, observation, or surgery.

Older Adults

Individuals typically aged 65 years and older, often characterized by increased healthcare needs and varying degrees of dependency or autonomy.

Middle Adults

Individuals typically between the ages of 40 and 65, often experiencing transitions in health, social roles, and responsibilities.

Q9: Identify which of the following statements is

Q20: What is line "C" pointing to?<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6090/.jpg"

Q29: Trace the path of a sperm cell

Q36: Which of the following is not a

Q55: Identify which of the following statements is

Q61: Which cells secrete testosterone?<br>A)Sertoli cells<br>B)Spermatogenic cells<br>C)Leydig cells<br>D)Oogonia<br>E)Chief

Q63: Which condition listed gives rise to sterile

Q65: Jeremey is a partner in the Jimimey

Q73: When phenotype can be drastically different depending

Q87: Which of the following statements is incorrect