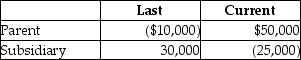

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year,the group files a consolidated tax return.The results for last year and the current year are:

Taxable Income

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Otitis Externa

An inflammation or infection of the external auditory canal, also known as swimmer's ear.

Acetic Acid Eardrops

A solution used in the treatment of outer ear infections that works by restoring the normal acidic environment of the ear canal.

Swab

A small piece of absorbent material on a stick or wire base, used to collect samples of substances from various parts of the body for testing or cleansing.

Hydrogen Peroxide

A chemical compound used as an oxidizer, bleaching agent, and antiseptic.

Q1: Identify which of the following statements is

Q2: Identify which of the following statements is

Q7: Inadequate exhalation of carbon dioxide can cause<br>A)Blood

Q27: Webster,who owns all the Bear Corporation stock,purchases

Q47: Broom Corporation transfers assets with an adjusted

Q68: Stan had a basis in his partnership

Q74: Clark and Lewis are partners who share

Q81: Identify which of the following statements is

Q95: What attributes of a controlled subsidiary corporation

Q114: Booth Corporation sells a building classified as