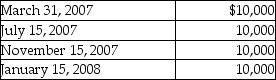

Sandy,a cash method of accounting taxpayer,has a basis of $46,000 in her 500 shares of Newt Corporation stock.She receives the following distributions as part of Newt's plan of liquidation.

The amount of the final distribution is not known on December 31,2007.What are the tax consequences of the distributions?

Definitions:

German Piano Manufacturer

A company based in Germany specializing in the creation and production of pianos.

Joint Venture

A business arrangement where two or more parties agree to pool their resources for the purpose of accomplishing a specific task or business activity.

Repatriation

The process of returning a person to their country of origin or citizenship, often used in the context of employees returning home after international assignments.

Foreign Assignments

Work tasks or roles allocated to employees in a location outside of their home country, typically as part of international business operations.

Q1: Alpha,Beta,Gamma,and Delta Corporations form a controlled group.Delta

Q7: What is line "A" pointing to?<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6090/.jpg"

Q8: A member's portion of a consolidated NOL

Q10: In a heterozygous individual for a certain

Q27: Where in the figure will you find

Q30: Rose and Wayne form a new corporation.Rose

Q50: Which structures in the figure together secrete

Q68: The transferor's basis for any noncash boot

Q75: In the last three years,Wolf Corporation had

Q89: Identify which of the following statements is