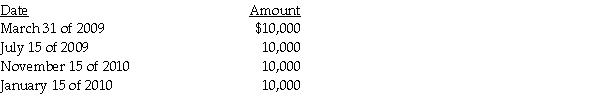

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Preferred Shares

Preferred Shares are a type of stock that grant holders preferential treatment over common stockholders in terms of dividends and assets during liquidation, but usually do not carry voting rights.

Rate of Return

The increase or decrease in the value of an investment, shown as a percentage of the original amount invested, over a given timeframe.

Floatation Costs

Flotation costs are the expenses incurred by a company in issuing new securities, including fees and commissions paid to underwriters, legal fees, and registration fees.

After-Tax Cost of Debt

This refers to the net cost of debt considering the effect of taxes, representing the actual financial cost of debt to a company after tax deductions.

Q7: Identify which of the following statements is

Q17: Perch Corporation has made paint and paint

Q19: Acquiring Corporation acquires all of the stock

Q35: If foreign taxes on foreign income exceed

Q35: Identify which of the following statements is

Q54: Dan transfers property with an adjusted basis

Q62: Martin operates a law practice as a

Q82: Richards Corporation has taxable income of $280,000

Q85: Jason,a lawyer,provided legal services for the employees

Q102: When appreciated property is distributed in a