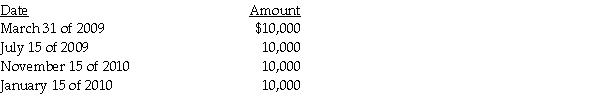

Jack has a basis of $36,000 in his 1,000 shares of Acorn Corporation stock (a capital asset).The stock was acquired three years ago.He receives the following distributions as part of a plan of liquidation of Acorn Corporation:

What are the amount and character of the gain or loss that Jack will recognize during 2009? During 2010?

Definitions:

Low-Context

A communication style where most of the information is explicitly stated in the message itself, requiring little understanding of context.

Ethnocentrism

The belief in the inherent superiority of one's own ethnic group or culture, often at the expense of other cultures.

Colloquial Expressions

Informal language or phrases used in everyday conversation and not suitable for formal contexts.

Open-Ended Questions

Open-ended questions are questions that allow for a wide range of responses, encouraging more detailed and thoughtful answers.

Q4: Alan,a U.S.citizen,works in Germany and earns $70,000,paying

Q5: Barbara owns 100 shares of Bond Corporation

Q10: Corporations are permitted to deduct $3,000 in

Q19: The ACE adjustment always increases alternative minimum

Q25: Acme Corporation acquires Fisher Corporation's assets in

Q27: Specialty Corporation distributes land to one of

Q35: Dumont Corporation reports the following results in

Q114: Identify which of the following statements is

Q118: Which of the following is not subject

Q123: JLA is a U.S.shoe manufacturer.Its domestic production