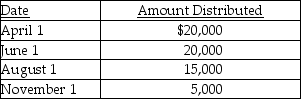

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.

The treatment of the $15,000 August 1 distribution would be

Definitions:

Applied Manufacturing Overhead

The portion of manufacturing overhead costs allocated to each unit of production, based on a predetermined rate.

Applied Manufacturing Overhead

Applied Manufacturing Overhead refers to the estimated overhead costs assigned to individual products based on a predetermined rate and actual activity levels.

Overhead

The indirect costs of running a business that are not directly associated with the production of goods or services, such as administrative expenses and rent.

Underapplied

A situation where the allocated or budgeted costs are less than the actual costs incurred, typically in the context of manufacturing overhead.

Q6: Checkers Corporation has a single class of

Q12: Dusty Corporation owns 90% of Palace Corporation's

Q17: When using the Bardahl formula,an increase in

Q21: Sparks Corporation receives a dividend of $100,000

Q24: A corporation is required to file Form

Q28: Identify which of the following statements is

Q45: Toby Corporation owns 85% of James Corporation's

Q86: Tracy has a 25% profit interest and

Q97: Pedro,a nonresident alien,licenses a patent to a

Q98: Which of the following intercompany transactions creates