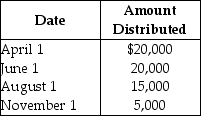

Payment Corporation has accumulated E&P of $19,000 and current E&P of $28,000.During the year,the corporation makes the following distributions to its sole shareholder:

The sole shareholder's basis in her stock is $45,000.What are the tax consequences of the June 1 distribution?

Definitions:

Rehabilitation Process

A set of therapies and activities designed to restore health or normal life to individuals after illness, injury, or addiction.

Rehabilitation/Restorative Facility

A healthcare setting focused on providing therapies and services to help individuals recover abilities or improve their condition after injury or illness.

Prospective Payment System

A healthcare payment method where the amount or rate of reimbursement is predetermined based on the diagnosis and/or procedures rather than basing it on the actual cost incurred.

Cost-Based Reimbursement

A payment method where healthcare providers are paid based on the costs of the services they deliver, often used by government programs.

Q8: Identify which of the following statements is

Q15: Corporate estimated tax payments are due April

Q29: What is the requirement for a substantial

Q41: Carol owns Target Corporation stock having an

Q50: U.S.citizen Barry is a bona fide resident

Q58: Identify which of the following statements is

Q69: Identify which of the following statements is

Q94: Parent Corporation purchases all of Target Corporation's

Q102: When appreciated property is distributed in a

Q125: West Corporation purchases 50 shares (less than