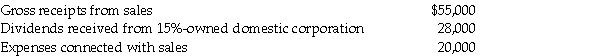

Francine Corporation reports the following income and expense items for the tax year ending December 31:

What is Francine Corporation's taxable income?

Definitions:

Ongoing Basis

refers to activities or processes that occur continuously or regularly, without a predetermined end point.

Instrumental Aggression

Harm-seeking done to another person that serves some other goal.

Affective Aggression

Harm-seeking done to another person that is elicited in response to some negative emotion.

Aggression

Any physical or verbal behavior that is intended to harm another person or persons (or any living thing).

Q3: Beth transfers an asset having an FMV

Q5: An advantage of filing a consolidated return

Q15: Nonresident aliens are not allowed to claim

Q41: The IRS will issue a 90-day letter

Q49: Lynn transfers property with a $56,000 adjusted

Q70: Deferred tax liabilities occur when expenses are

Q74: Identify which of the following statements is

Q92: Table Corporation transfers one-half of its assets

Q93: The stock of Cooper Corporation is 70%

Q94: Discuss the use of a "tax haven"