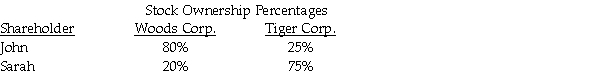

Woods and Tiger Corporations have only one class of stock outstanding,owned by the following individuals:

Are Woods and Tiger members of a brother-sister controlled group? Why or why not?

Definitions:

Accounts Receivable

Unpaid amounts by customers to a company for goods or services already rendered.

Cash Receipts Journal

A dedicated journal used to record all cash inflows or receipts of a business.

Sales of Merchandise

The total revenue generated from selling goods that are intended for resale as part of a company's normal business operations.

Purchases Journal

A specialized accounting journal used to record all purchases of merchandise, supplies, or other goods on credit.

Q22: Jayne and Jon jointly file a tax

Q23: In 2000,Mike transfers $100,000 of leased land

Q37: Cane Corporation owns 45% of the stock

Q50: Joker Corporation owns 80% of Klue Corporation.Joker

Q57: Courtney Corporation had the following income and

Q64: Once a corporation has elected a taxable

Q80: In 2012,Paul transfers $1,000,000 to a trust

Q99: Trusts are required to make estimated tax

Q100: When a liquidating corporation pays off an

Q104: Identify which of the following statements is