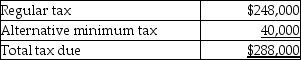

Grant Corporation is not a large corporation for estimated tax purposes and reports on a calendar-year basis.Grant expects the following results:

Grant's tax liability for last year was $240,000.Grant's minimum total estimated tax payment for this year to avoid a penalty is

Definitions:

Rite Of Passage

A ritual or ceremony that marks a significant transition or stage in a person's life, such as puberty or marriage.

Initiation Ceremony

A formal event or series of actions conducted to admit someone into a new status or community.

Moral Intuition

Instantaneous judgments of right and wrong that occur without conscious deliberation, often based on emotional reactions.

Blood-Brain Barrier

A selective semipermeable barrier that shields the brain from foreign substances in the blood that might harm it, while allowing essential nutrients to pass through.

Q12: Sun and Moon Corporations each have only

Q26: Julian died on November 1 and owned

Q30: If the taxpayer has credible evidence,the IRS

Q30: For the foreign credit limitation calculation,income derived

Q51: Which of the following items will not

Q51: In a Type B reorganization,the target corporation

Q66: What are the tax consequences to Whitney

Q81: Boxer Corporation buys equipment in January of

Q102: Four years ago,Roper transferred to his son

Q104: A trust has net accounting income of