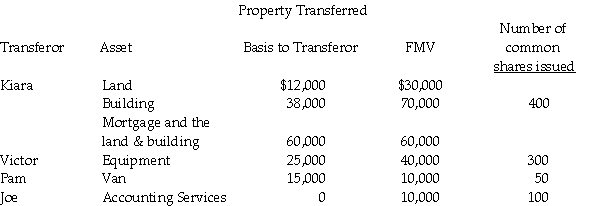

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Effective Interest Rate

The equivalent annually compounded rate of interest.

Lump Sum

A single payment made at a particular time, as opposed to a series of payments made over time.

Monthly Compounded

Refers to the process of calculating interest on both the initial principal and the accumulated interest from previous periods on a monthly basis.

Nominal Rate

The interest rate before adjustments for inflation, often referred to as the stated or face value rate of interest.

Q10: A simple trust<br>A)may make charitable distributions.<br>B)may make

Q13: One of your corporate clients has recently

Q23: Alice owns 56% of Daisy Corporation's stock

Q32: Identify which of the following statements is

Q45: Identify which of the following statements is

Q45: Identify which of the following statements is

Q78: Discuss the ways in which the estate

Q81: Which of the following items are tax

Q91: Yellow Trust must distribute 33% of its

Q117: Upon formation of a corporation,its assets have