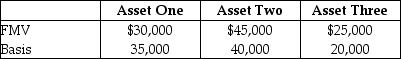

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec.351.

Max's recognized gain is

Definitions:

Mother's Bloodstream

The circulatory system of a pregnant woman through which nutrients, gases, and wastes are exchanged with the fetus.

Inherited

Passed down genetically from parents to their offspring, referring to traits, conditions, or predispositions.

Nipple

A small projection from the breast or mammary glands through which milk is delivered to an infant.

Cheek

The fleshy part of the face below the eye and between the nose and ear, used for expressing emotions and tasting food.

Q3: In 1998,Delores made taxable gifts to her

Q33: The general business credit can be used

Q35: Which of the following items can be

Q40: Billy,a calendar-year taxpayer,files his current year individual

Q68: A taxpayer may make the election to

Q70: Identify which of the following statements is

Q74: Identify which of the following statements is

Q84: Reba,a cash basis accountant,transfers all of the

Q103: Sally transfers property to a revocable trust.Under

Q108: Lynn transfers land having a $50,000 adjusted