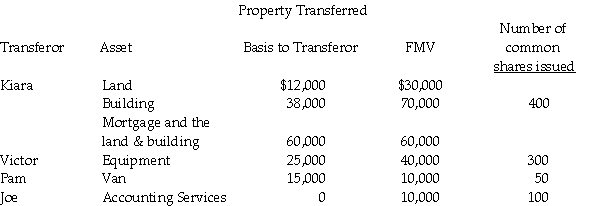

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Solver

A software tool or function that finds the optimal solution to a mathematical problem or equation by varying multiple variables within constraints.

Personnel Limitation

Constraints or restrictions related to the number or capabilities of staff available for a project or operation.

Net Present Value

A calculation used to evaluate the profitability of an investment, subtracting the present values of cash outflows from the present values of cash inflows.

Binary Variable

A variable that takes on one of exactly two possible values, typically represented or coded as 0 and 1.

Q46: All of the following are recognized as

Q56: Dreyfuss Corporation reports the following items: <img

Q57: List the various categories of estate tax

Q66: Identify which of the following statements is

Q80: Pablo,a bachelor,owes $80,000 of additional taxes,all due

Q80: Apple Trust reports net accounting income of

Q93: What is the tax treatment for a

Q94: Discuss the use of a "tax haven"

Q105: Carmen and Marc form Apple Corporation.Carmen transfers

Q115: Identify which of the following statements is