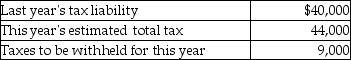

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits.Determine the amount of the minimum quarterly estimated tax payments required to avoid the penalty.Assume your client's adjusted gross income last year was $140,000.

Definitions:

Constitutional guarantee

A commitment within a country's constitution that ensures certain rights and freedoms to its citizens.

Equal Protection clause

A provision in the Fourteenth Amendment of the U.S. Constitution that requires state governments to treat individuals in similar situations equally.

Diversity

The inclusion of individuals from a variety of backgrounds, perspectives, and abilities in a group or organization.

Quotas

Preset limits or targets for a specific measurement, such as production, immigration, or tariffs, within a given timeframe.

Q4: Access Corporation,a large manufacturer,has a taxable income

Q21: The alternate valuation date can be elected

Q23: Karly created a $300,000 trust that provided

Q32: The election of Subchapter S status by

Q77: Describe the domestic production activities deduction.

Q80: Section 351 applies to an exchange if

Q93: Mary died this year.Her will creates a

Q103: Dallas Corporation,not a dealer in securities,realizes taxable

Q105: On November 30,Teri received a current distribution

Q106: During the year,Soup Corporation contributes some of