Essay

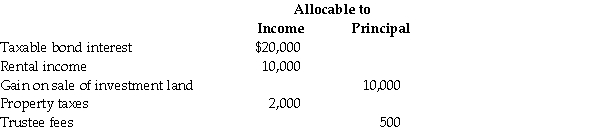

A trust reports the following results:

The trust must distribute all of its income annually.Calculate taxable income after the distribution deduction.

Definitions:

Related Questions

Q1: Identify which of the following statements is

Q32: The distribution deduction for a complex trust

Q42: In all situations,tax considerations are of primary

Q48: Ben and Jerry Corporations are members of

Q68: Which of the following statements is true?<br>A)If

Q69: Ten years ago,Latesha acquired a one-third interest

Q82: Connie's Restaurant has been an S corporation

Q100: Glacier Corporation,a large retail sales company,has a

Q104: S corporations must allocate income to shareholders

Q119: Jeremy transfers Sec.351 property acquired three years