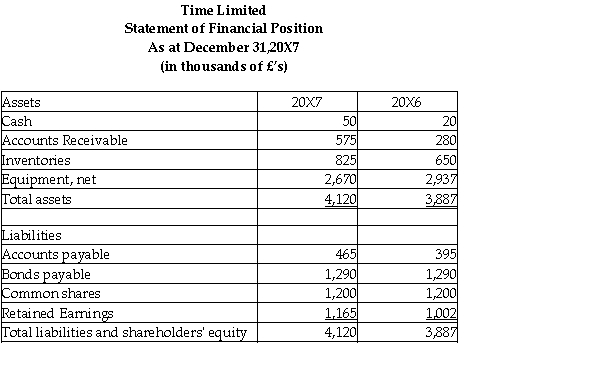

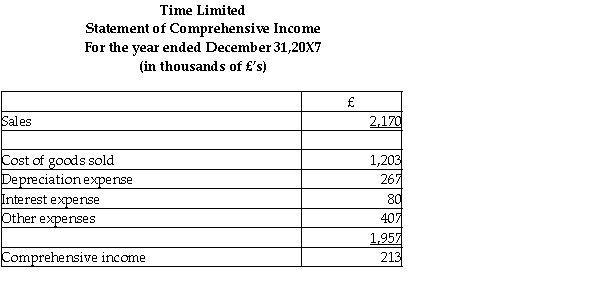

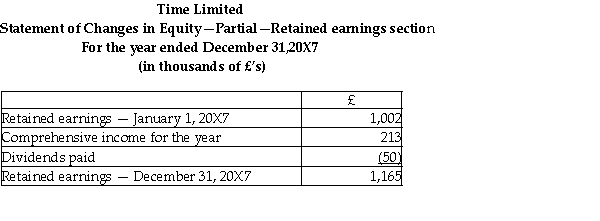

On January 1,20X7,Clock Inc.of Vancouver,British Columbia,purchased 75% of the outstanding shares of Time Limited,in London England.Time Limited's statements of financial position,statements of comprehensive income and changes in equity - retained earnings section for the year ended December 31,20X7 are below.

Additional information:

1.Time was incorporated on January 1,20X3 when it acquired all its equipment for £4,005,000 and issued its 10 year bonds payable.

2.Time's purchases and sales occurred evenly over the year.Inventories on hand at December 31,20X6 and December 20X7 were purchased evenly over the last quarter of 20X6 and 20X7,respectively.Inventories as at December 31,20X7 were £650,000.

3.Dividends were paid on March 31,20X7.

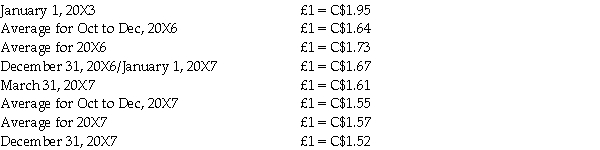

4.Foreign exchanges rates are as follows:

Required:

Translate Time's statement of financial position as at December 31,20X7 into Canadian dollars assuming its functional currency is Canadian dollars.Calculate the translation gain or loss arising in 20X7.

Definitions:

Net Capital Outflow

The difference between the domestic purchase of foreign assets and the foreign purchase of domestic assets over a given period, reflecting the flow of capital from and into a country.

Barriers To Trade

Measures imposed by governments or policies that restrict or restrain international trade, through tariffs, quotas, or other regulations.

U.S. Exports

Goods and services produced in the United States and sold to other countries.

U.S. Imports

Goods and services purchased from other countries by the United States, contributing to its domestic consumption, investment, and government spending.

Q4: What is the only item that will

Q7: Under the temporal method,which of the following

Q12: Dupuis Ltd.acquired Waul Ltd.through a business combination

Q13: Faulk Ltd.has provided the following information:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1557/.jpg"

Q28: In a not-for-profit organization,donated capital assets are

Q29: Food for All (FFA)is a non-profit organization

Q39: Which of the following items is a

Q139: Which of the following statements best describes

Q206: Which of the following statements best describes

Q315: recent Congressional initiative mandated that the U.S.Department