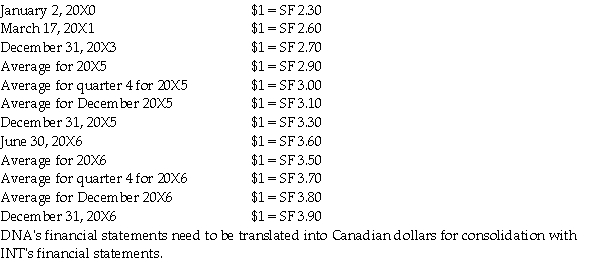

DNA was incorporated on January 2,20X0 and commenced active operations immediately.Common shares were issued on the date of incorporation and no new common shares have been issued since then.On December 31,20X3,INT purchased 70% of the outstanding common shares of DNA for 800,000 Swiss francs (CHF).

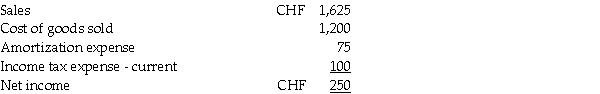

DNA's main operations are located in Switzerland.For the year ending December 31,20X6,the income statement (in 000s)for DNA was as follows:

The comparative and condensed statements of financial position (in 000s)for DNA were as follows:

OTHER INFORMATION:

• Purchases and sales of merchandise inventory occurred evenly throughout the year.

• The ending inventory was purchased evenly throughout the last month of the year.

• DNA had purchased the capital assets on hand at the end of 20X6 on March 17,20X1.There were no purchases or sales of capital assets from 20X3 to 20X6.

• Dividends were paid on June 30,20X6.

Assume that foreign exchange rates were as follows:

Required:

Translate DNA's balance sheet (excluding retained earnings)at December 31,20X6 into Canadian dollars under the temporal method.

Definitions:

Part-Time Working

Employment characterized by fewer hours worked per week compared to full-time positions, offering flexibility and potentially balancing other commitments.

Transition to First Parenthood

The process of adjusting to the new role and responsibilities of being a parent for the first time, which can involve significant changes in identity, relationships, and daily routines.

Core Housework

Fundamental domestic tasks necessary for maintaining a household, such as cleaning, cooking, and laundry.

Mismatched Expectations

A discrepancy between what is expected and what actually occurs, often leading to dissatisfaction or conflict.

Q16: In Canada and the United States,at a

Q26: On January 1,20x4,HB Inc.issued 10,000,000 Euros (€)of

Q31: Discount on bonds payable is considered to

Q36: On December 31,20X5,CI Co.purchased 100% of the

Q37: Hurricane Inc.wants to acquire 100% of the

Q55: Premium on bonds payable is considered to

Q120: element of the marketing mix demonstrated when

Q146: Diversification refers to the marketing strategy of<br>A)

Q148: Consider Figure 2-7 above.A Florida-based flashlight company

Q188: local candidate running for office would very