HCB,a Canadian public company,entered into the following transactions late in 20X6:

• Transaction #1 - On October 15,HCB purchased inventory from a Mexican supplier for 800,000 pesos (Ps).On the same day,HCB entered into a forward contract for Ps 800,000 at the 60-day forward rate of Ps1 = $0.399.The company has designated this as a fair value hedge.The Mexican supplier was paid in full on December 15,20X6.

• Transaction #2 - On November 1,HCB contracted to sell inventory to a customer in Switzerland at a selling price of CHF 400,000.The contract called for the merchandise to be delivered to the customer on December 1,with payment to be received in Swiss francs by January 31,20X7.On November 1,HBC arranged a forward contract to deliver CHF 400,000 on January 31,20X7 at a rate of CHF1 = $1.20.The company has designated this as a fair value hedge on a firm commitment.

• On December 1,20X6,the forward rate on the Swiss francs to January 31,20X7 was CHF1 = $1.21

• The company has a December 31,20X6 year end.On this date the forward rates for the Swiss francs was CHF1 = $1.23.

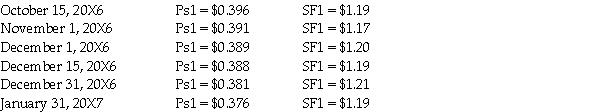

HBC has a year-end of December 31.Spot rates were as follows during this period of time:

Required:

The company uses the net method to record hedging transactions.Prepare the journal entries that HCB should make to record the events described above.

Definitions:

Hepatic Vein

A vein that drains de-oxygenated blood from the liver into the inferior vena cava.

Axillary Vein

A vein that conveys blood from the lateral aspect of the thorax, armpit, and upper limb toward the heart.

Inferior Vena Cava

A large vein carrying deoxygenated blood from the lower body to the heart.

Superior Vena Cava

A large vein that carries deoxygenated blood from the upper body to the heart.

Q3: Under the temporal method,which of the following

Q14: Fox owns 60% of the outstanding common

Q14: Lopez Ltd.purchases 65% of Wheatfall Co.Under the

Q59: The market rate is the rate used

Q74: Describe the three levels in an organization.

Q77: Explain the marketing program 3M used to

Q111: Which of the following is the best

Q136: marketing mix elements are called _ because

Q209: Which of the following statements describes an

Q220: marketing strategy refers to<br>A) the means by