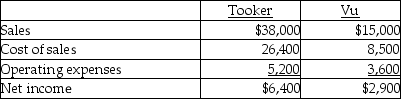

Tooker Co.acquired 80% of the outstanding common shares of Vu Ltd.There were no fair value increments or goodwill that arose with the purchase.During 20X1,Tooker sold $7,000 of inventory to Vu for a gross profit of 40%.At the end of 20X1,$3,000 of the inventory is still in Vu's inventory.On their single-entity income statements for 20X1,Tooker and Vu reported the following:

Vu sold all the goods from Tooker that were in its opening inventory.There were no sales between Tooker and Vu in 20X2.At the end of 20X2,what portion of consolidated net income is attributable to Tooker?

Definitions:

Present Value

Present value is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

Comprehensive Income

An overall measure of all changes in equity from non-owner sources, capturing both realized and unrealized gains and losses.

Cost-Cutting Project

Initiatives or plans implemented by a business to reduce its expenses and increase efficiency, aiming to improve overall profitability.

Erosion

In finance, the gradual reduction of the value of an asset or earnings, often due to external factors or new projects cannibalizing existing project revenues.

Q23: Bates Ltd.owns 60% of the outstanding common

Q26: Contingent liabilities sometimes pose an ethical challenge

Q38: Clearly distinguish between a government business organization

Q39: With respect to interim financial statements,which of

Q51: A certain contingent liability was evaluated at

Q55: Premium on bonds payable is considered to

Q59: The market rate is the rate used

Q98: of the following are departments in a

Q111: The balance in the Bonds payable is

Q175: Marketing seeks to discover the needs and