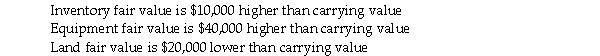

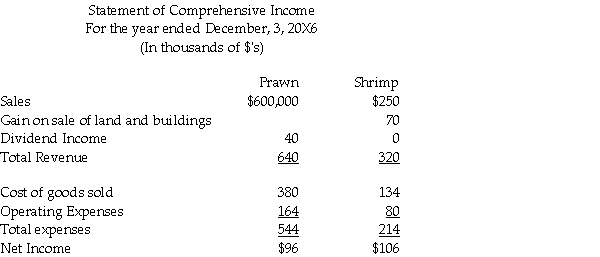

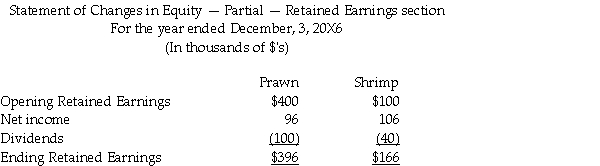

Prawn Corporation owns 80 percent of the outstanding voting shares of Shrimp Corporation,having acquired its interest January 1,20X3 for $100,000.At the time of the acquisition,Shrimp Corporation had a shareholder's equity totalling $150,made up for retained earnings of $30,000 and common shares of $20,000.The following accounts had fair values higher (or lower)than its carrying values:

The equipment had a remaining useful life at the time of acquisition of five years.

The company uses the entity approach to determine the amount of goodwill.

The balance of the land and buildings at December 31,20X6 for Prawn totalled $895,000 and for Shrimp totalled $450,000.

Additional Information:

1.Shrimp had reported $50,000,relating to land (40%)and building (60%)sold to Prawn on January 3,20X5.These separate properties had not been owned on January 1,20X3.Remaining useful life was expected to be 10 years at that time.

2.Shrimp sold other land to a non-related company at a gain of $20,000 on June 30,20X6.

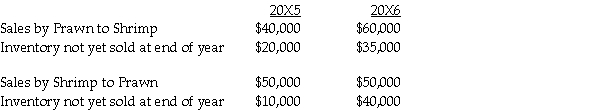

3.Intercompany sales and inventory data for 20X5 and 20X6:

Profit margins on sales by Prawn to Shrimp are 40%.

Profit margins on sales by Shrimp to Prawn are at 30%.

Required:

Calculate the following consolidated balance as at December 31,20X6:

a.Retained earnings

b.Land and Buildings

Definitions:

Human Flourishing

A concept in moral philosophy that relates to living well and realizing one's full potential through ethical and virtuous actions.

Golden Mean

Aristotle's concept of finding the desirable middle between two extremes, one of excess and the other of deficiency.

Theory of Moderation

A philosophical principle suggesting that moderation in all things is the key to a good life, avoiding extremes in behavior, beliefs, and actions.

Athenian Gentleman

Historical term referring to a male citizen of ancient Athens who adhered to principles of personal virtue, wisdom, and civic responsibility.

Q6: Walmart,Southwest Airlines,and Costco all have been successful

Q18: On January 1,20X8,XZ Co.purchased 3,000 shares,representing 30%

Q22: Beauty Care Limited (BCL)manufactures and distributes leather

Q30: Mallard Ltd.acquired 75% of the outstanding common

Q36: Which of the following is the amount

Q47: Short Link Company (SLC)issued a purchase order

Q84: If a bond's stated interest rate is

Q112: Accounts payable is always shown on the

Q170: Figure 1-2 above,"D" represents a firm's relationship

Q260: attend a winter concert presented by the