On December 31,20X2,the Esther Company purchased 80% of the outstanding common shares of the Jane Company for $7.5 million in cash.On that date,the shareholders' equity of Jane totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings.Both companies use the straight-line method to calculate depreciation and amortization.Goodwill,if any arises as a result of this business combination,is written down if there is a permanent impairment in its value.

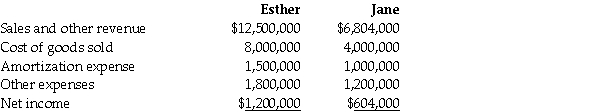

For the year ending December 31,20X4,the statements of comprehensive income for Esther and Jane were as follows:

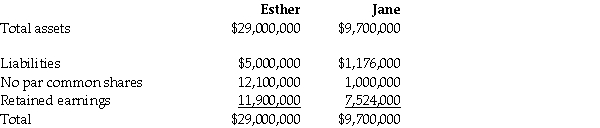

At December 31,20X4,the condensed statements of financial position for the two companies were as follows:

OTHER INFORMATION:

1.On December 31,20X2,Jane had a building with a fair value that was $450,000 greater than its carrying value.The building had an estimated remaining useful life of 15 years.

2.On December 31,20X2,Jane had inventory with a fair value that was $150,000 less than its carrying value.This inventory was sold in 20X3.

3.During 20X3,Jane sold merchandise to Esther for $100,000,a price that included a gross profit of $50,000.During 20X3,40% of this merchandise was resold by Esther and the other 60% remained in its December 31,20X3 inventories.On December 31,20X4,the inventories of Esther contained merchandise purchased from Jane on which Jane had recognized a gross profit in the amount of $20,000.Total sales from Jane to Esther were $150,000 during 20X4.

4.During 20X4,Esther declared and paid dividends of $300,000 while Jane declared and paid dividends of $100,000.

5.Esther accounts for its investment in Jane using the cost method.

Required:

Calculate the non-controlling interest on the consolidated statement of financial position as at December 31,20X4 under the entity method.

Definitions:

Cultural Perception

Refers to how culture shapes the way individuals interpret and understand the world around them.

Circular Time

A concept of time viewed as cyclical, often found in certain cultures and philosophies, contrasting with the linear perception of time.

Usage Situations

Contexts or environments wherein a product or service is utilized, affecting consumer behavior and marketing strategies.

Segmented

Divided into distinct groups or sections, often used in marketing to target specific demographics or interests.

Q2: Mallard Ltd.acquired 75% of the outstanding common

Q13: World Doctors (WD)is a non-profit-organization that provides

Q16: Which methods will result in the same

Q21: Which of the following would be included

Q27: What is the purpose of showing an

Q32: Fransen Co.does a lot of businesses in

Q38: How should the transaction costs of issuing

Q39: One of the programs that the Tyger

Q40: HCB,a Canadian public company,entered into the following

Q252: Terrafugia Transition is a flying car with