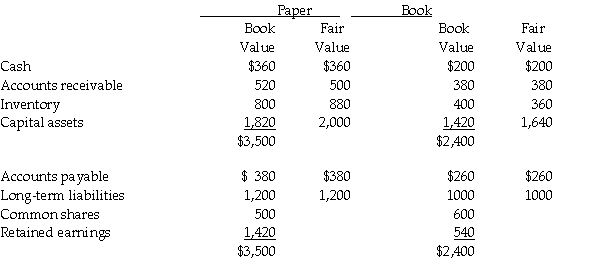

On December 31,20X5,Paper Co.purchased 60% of the outstanding common shares of Book Ltd.for $760,000 in shares and $200,000 in cash.The statements of financial position of Paper and Book immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Required: Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method: a.Goodwill b.Non-controlling interest c.Capital assets,net" class="answers-bank-image d-block" rel="preload" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d055_8673_1dfe378b5f0b_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_d056_8673_f38479e292e5_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1097_f767_8673_0b473c8c4909_TB1557_00

Required:

Calculate the following items as they would appear on the Paper Co.'s consolidated statement of financial position at December 31,20X7 under the entity method:

a.Goodwill

b.Non-controlling interest

c.Capital assets,nets) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.